How Does The Employee Retention Tax Credit Work

ERTC Funding can be complicated but we can help.

If you’re an employer who has experienced a significant decrease in business due to the COVID-19 pandemic, you may be eligible for the Employee Retention Tax Credit (ERTC) offered by the Internal Revenue Service (IRS). This credit is designed to help employers offset payroll costs related to keeping employees on staff.

In this article, we’ll provide an overview of the ERTC, explain eligibility requirements and qualified wages, discuss how to claim the credit, and provide additional considerations. Read on to get started!

The ERTC provides employers with a refundable tax credit equal to 50% of up to $10,000 in wages paid by an eligible employer whose business operations were fully or partially suspended due to orders from a governmental authority related to COVID-19. So if you’ve been struggling financially due to decreased revenue during this time period, this could be a great way for your business to receive some financial relief.

Overview of the Employee Retention Tax Credit

You have the power to keep your employees safe and supported during these uncertain times – learn more about the Employee Retention Tax Credit!

The Employee Retention Tax Credit (ERTC) is a tax break offered by the federal government to help businesses retain their employees during the pandemic. It was created as part of the Coronavirus Aid, Relief, and Economic Security Act (CARES) in 2020.

This credit allows eligible employers to receive up to $5,000 per employee for wages paid or incurred after March 12, 2020 and before January 1, 2021. The ERTC is available to employers with fewer than 500 full-time employees that have experienced a decline in gross receipts of 50% or more compared to last year’s same quarter. In addition, employers who receive Paycheck Protection Program (PPP) loans are also eligible for this credit.

The ERTC provides an incentive for businesses to keep their workers on the payroll despite experiencing financial difficulties due to COVID-19. This credit can be used by businesses of all sizes across industries ranging from restaurants and retailers to manufacturers and health care providers.

Eligible employers can claim a tax credit equal to 50% of qualified wages paid up to $10,000 per employee each year between March 12th 2020 and December 31st 2020 (or January 1st 2021 if extended). Employers can choose between receiving a refundable tax credit or reducing their income tax liability; however they cannot pursue both options simultaneously.

In order for an employer’s wages to qualify for ERTC, they must meet certain criteria such as being paid during the time period specified above and not being excluded from other relief programs like PPP loans.

Additionally, any payments made after December 31st will not qualify unless they are directly related to expenses such as vacation pay accrued before June 30th 2020 but not paid until afterwards.

Lastly any payments made with funds received under PPP loans are ineligible for ERTC claims since those funds have already been subsidized through other assistance programs provided by Congress specifically designed for small business owners affected by COVID-19 pandemic related losses in revenue.

Claiming the ERTC is easy; you just need your records showing that you’ve met all requirements including providing proof of decline in gross revenue if applicable as well as documentation demonstrating you’ve paid qualifying wages that aren’t associated with other sources of relief funding like PPP loans etc.

Once you’ve gathered all necessary documents simply provide them when filing quarterly taxes or submit Form 941 which is available online at IRS website along with instructions detailing how it should be completed correctly so that you receive maximum benefit from this valuable program designed specially to help struggling business owners stay afloat during these challenging times while still taking care of their most valuable asset…their people!

What is the Employee Retention Credit?

The Employee Retention Credit (ERC) or Employee Retention Tax Credit (ERTC) is a payroll tax refund born out of the same COVID relief bill as PPP which incentivized businesses who kept employees on payroll during the pandemic. Your business can claim ERC even if you received PPP funds. That’s great news.

Eligibility Requirements For ERTC

To be eligible, you must meet certain criteria – don’t miss out on this great opportunity!The Employee Retention Tax Credit (ERTC) is a refundable tax credit available to employers who have experienced a significant decline in gross receipts during 2020 or 2021 due to the coronavirus pandemic.

To qualify for the ERTC, your business must have had an overall reduction in gross receipts of more than 20% compared to the same quarter in 2019. Additionally, you must also have kept at least one employee on payroll throughout the quarter and paid them wages of at least $10,000 for that quarter.

The ERTC can provide up to 70% of qualified wages per employee for 2020 and 2021, up to a maximum credit amount of $7,000 per employee each year. This means that if you’re eligible for the credit and paid $10,000 or more in wages during the qualifying period, then you could receive a tax credit of up to $7,000 per employee. The amount of your credit will depend on how much your gross receipts declined during the qualifying period versus 2019.

You should apply as soon as possible since there are limited funds available through this program – act quickly so that you don’t miss out! You’ll need to fill out Form 941-X and submit it along with all applicable documents and supporting information related to your eligibility. Once approved by the IRS, they will issue you a refundable tax credit equal to 70% of qualified wages paid during 2020 or 2021 (up to $7,000).

It’s important that businesses take advantage of programs like these when they become available – especially those who are struggling due to financial hardship caused by COVID-19 restrictions. Take some time today to evaluate whether or not your business meets the eligibility requirements for this program so you can decide if taking advantage of it is right for you.

Find out if you qualify for an Employee Retention Tax Credit.

- Employee Retention Credit

The Employee Retention Credit (ERC) is a payroll tax refund from the United States Treasury Department applicable to businesses who kept employees on payroll during the pandemic.

- Risk-free consultation

You won’t have to pay anything if you don’t qualify. Unlike some other shady ERC competitors, we don’t charge contingency fees, it is against the law. You will know up front what we’re going to charge you.

- We take responsibility

Staying 100% compliant with the IRS guidelines is our priority! We will not try to overqualify your refund. Some other ERC companies DO NOT fill or sign the 941 x (amended forms submitted to the IRS) which would mean they would not be responsible for anything. We do!

Qualified Wages

By taking advantage of the Employee Retention Tax Credit, businesses can receive a refundable tax credit for up to 70% of qualified wages paid during 2020 and 2021, up to a maximum of $7,000 per employee.

Qualified wages are defined as those that are used for payroll costs such as salaries, wages, and health benefits.

In order to be eligible for the credit, an employer must have experienced either a full or partial suspension of their operations due to COVID-19 related orders from an appropriate governmental authority or a significant decline in gross receipts compared to the same quarter in 2019.

Qualifying employers may take advantage of the tax credit by filing Form 941 with the Internal Revenue Service (IRS).

The IRS will then calculate the credit based on eligible wages paid during each quarter.

Employers may also offset any additional payroll taxes they owe when filing their quarterly returns.

It is important to note that only employers with fewer than 500 employees are eligible for this tax credit.

Employers who take advantage of this program must also keep detailed records documenting how they determined eligibility and calculated their credits on Form 941C-V.

This includes all relevant documentation such as hiring dates, termination dates, and hours worked by each employee along with payment information for all qualified wages paid during the period covered by the return.

Additionally, employers should maintain documentation regarding any other changes made in response to COVID-19 related orders from applicable government authorities.

The Employee Retention Tax Credit is designed to help businesses retain their employees during difficult times so that they can rebound quickly once restrictions have been lifted and business activity resumes at normal levels again.

By taking advantage of this program, employers can reduce payroll costs while ensuring that their employees remain employed throughout these uncertain times.

Maximum Credit

With the Employee Retention Tax Credit, businesses can get a refundable tax credit of up to 70%, maxing out at $7,000 per worker. This maximum credit is determined by a number of factors, including the size of the employer and the amount of wages paid to each employee.

The total allowable credit for an employer is limited to 50% of qualified wages paid in 2020, up to a maximum of $5,000 per employee. For employers with more than 100 full-time employees in 2019, the credit is limited to 70% of qualified wages paid in 2020, up to a maximum of $7,000 per employee.

The amount that can be claimed as part of this tax credit depends on how many employees you have and what their average wages are. If you have fewer than 100 full-time employees in 2019 and pay them an average wage that is less than $10,000 during 2020 then you qualify for the 50% rate or $5,000 per worker cap. However, if your business has more than 100 full-time employees and pays them an average wage greater than $10,000 then you qualify for the 70% rate or $7,000 cap per worker.

The Employee Retention Tax Credit was introduced as part of the Coronavirus Aid Relief and Economic Security (CARES) Act in March 2020. It is designed to help businesses offset some costs associated with continued payroll expenses due to reduced revenue caused by COVID-19 closures or restrictions on operations.

The goal is to encourage employers to keep as many workers employed as possible during these challenging economic times.

Businesses can claim this tax credit when filing their quarterly taxes for 2020 but must provide evidence that they were affected by COVID-19 related closures or restrictions which led to a reduction in revenue compared with previous years’ figures before claiming it. If approved by IRS, they will receive refunds equal up to 70%, maxing out at $7,000 per employee on their eligible wages paid between March 13th – December 31st 2020 allowing them some financial relief while they recover from pandemic losses incurred earlier this year.

How to Claim the Employee Retention Tax Credit

You can get a refundable tax credit to help with the financial burden of COVID-19 losses and keep your staff on board – just make sure you meet all the requirements for claiming it.

To be eligible, your business must have been fully or partially suspended due to government orders related to COVID-19 between March 12, 2020, and December 31, 2020. You must also have fewer than 500 full-time employees in 2019.

The credit is equal to 50% of qualified wages paid up to $10,000 for each employee for the year. Qualified wages are those that were paid after March 12, 2020 and before January 1, 2021 but exclude wages that are part of a deferral agreement entered into after March 12th. The maximum amount allowed per employee is $5,000 which means that you can get up to $5 million as an employer if you had 500 employees during 2019.

In order to claim the tax credit, employers need to file Form 941 (Employer’s Quarterly Federal Tax Return) along with IRS Form 7200 Advance Payment of Employer Credits Due To COVID-19 with their federal income tax return. The form will allow the employer to figure out how much they owe in taxes and report any advance payments received from the IRS so they can reconcile them against their total liability at the end of the year.

Additionally, businesses should include Schedule R (Credit for Sick and Family Leave) when filing their taxes in order for it to get applied properly towards their taxes due.

Businesses may also want to consult with a professional accountant or lawyer as there are certain rules that need to be followed in order for them to qualify for this tax credit such as proper documentation requirements and specific eligibility criteria which could vary depending on state laws as well. It’s important to not only understand these rules but also ensure compliance by following them correctly when filing taxes in order to receive this valuable benefit from Uncle Sam.

Additional Considerations

Gaining financial relief from the employee retention tax credit can be a great way to help during this difficult time, but there are certain considerations you should take into account before filing your taxes.

First and foremost, it’s important to note that this credit is only available if your business has been subject to closure due to COVID-19 related restrictions. As such, you must qualify for the credit in order for it to be applicable.

Additionally, it’s important to understand that the amount of the credit depends on how many employees your business has retained and their wages. The Internal Revenue Service (IRS) limits the amount of tax credits depending on both factors, so you may not receive as much as you initially thought.

It’s also critical to remember that businesses have different eligibility requirements based on their size and structure. For example, employers with 500 or fewer employees may qualify for a maximum of $5,000 per employee while those with more than 500 employees might qualify for up to $7,000 per employee in some cases. In addition, sole proprietors or self-employed individuals should review their individual circumstances before claiming the credit since they are subject to different rules than larger employers.

Finally, keep in mind that businesses claiming the Employee Retention Tax Credit cannot also claim deductions associated with wage expenses covered by the credit. This means that any wages paid using funds obtained through this program will not be eligible as a deduction against taxable income when filing taxes next year; however, businesses can still claim other deductions such as rent payments and utilities expenses depending on their situation.

When considering taking advantage of this tax incentive, it is essential to understand all aspects involved including eligibility requirements and potential limitations in order to make sure you get the maximum benefit possible for your business during these unprecedented times.

Resources and Guidance

Taking advantage of the Employee Retention Tax Credit could be a major benefit to your business, but it’s important to understand all the details before diving in.

To get started, there are a few key resources and guidance available to help you make sure you’re taking full advantage of this opportunity. The IRS website includes detailed information on how employers can qualify for and claim the credit, as well as any updates related to eligibility or changes in law.

Additionally, the U.S. Small Business Administration has an online learning center with helpful videos and webinars that can provide more in-depth information about tax credits and other government assistance programs.

For further advice and expertise, consider working with a qualified accountant or financial advisor who specializes in tax planning for businesses. They can provide expert guidance on filing requirements, deadlines, and other important considerations related to claiming the credit from the IRS.

It’s also beneficial to keep track of state laws regarding employee retention credits; many states offer additional benefits such as reduced payroll taxes or extended time frames for claiming credits so researching your specific location is worth investigating further.

Finally, if you plan on hiring employees back after being laid off due to COVID-19 then you may also want to look into grants funded by the CARES Act which could offer additional support not available through ERTCs or other standard tax deductions.

In addition to helping fund payroll costs while rebuilding staff levels these grants can also cover some expenses associated with implementing safety protocols or transitioning operations back into normal operations mode following shutdowns due to pandemics or natural disasters such as hurricanes and floods.

No matter what approach best fits your business’ needs it’s essential that you have access to reliable resources when making decisions about taxes and employee retention strategies during uncertain times like these.

Taking time now will save headaches down the road when filing returns or dealing with unexpected issues that come up throughout the year — getting informed on all potential options is always a smart investment!

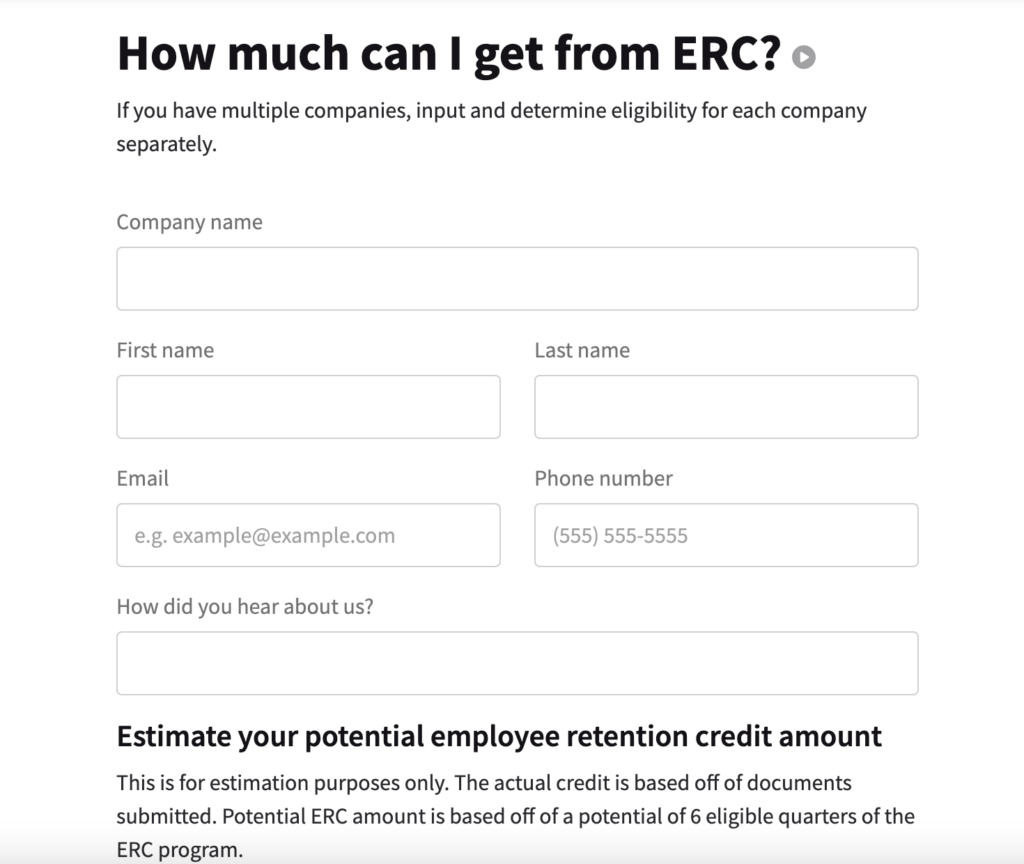

Getting started just takes 10 minutes.

Just fill out our form, leading you through a series of well-defined questions that matches your eligibility with the payroll tax refund. Over 80% of business that apply qualify. Here are five signs that you’re eligible

Conclusion

You now have a better understanding of the employee retention tax credit and how it works.

You know that to be eligible, you must have experienced business impacts due to the COVID-19 pandemic.

Qualified wages are limited, but the maximum credit is generous.

You also know how to claim the credit and what other considerations may apply.

With all this information, you can make an informed decision about whether or not this tax credit can benefit your business.

If you need more help or guidance on this topic, there are plenty of resources available online or through your local tax preparation service provider.